Company wealth generation drives investor returns

Approach

Fundamental, bottom-up, high conviction stock picking.

Objective

Superior portfolio returns over multiple cycles.

Target

Companies capable of sustaining exceptional rates of wealth creation over the long term.

Past performance is not a guide to future performance and returns may also increase or decrease as a result of currency fluctuations.

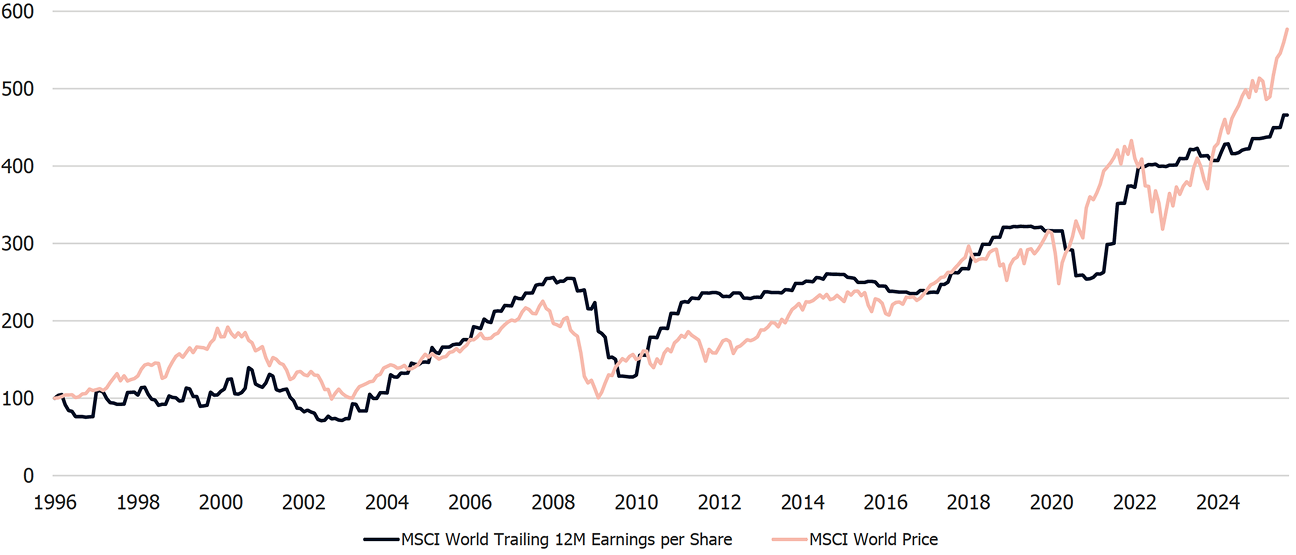

Fundamentals drive returns

Over time share prices track earnings growth. In the short run, share prices are influenced by sentiment, liquidity, and speculation in the markets. We believe that over the long run, corporate earnings - not markets - drive share prices, and consequently, portfolio returns are a function of the earnings growth delivered by each company.

Source: Bloomberg, MSCI, 30 September 2025. MSCI World EPS and Price in USD rebased to 100 on 31 January 1996. Past performance is not a guide to future performance and returns may also increase or decrease as a result of currency fluctuations. Please refer to the appendix for important information.

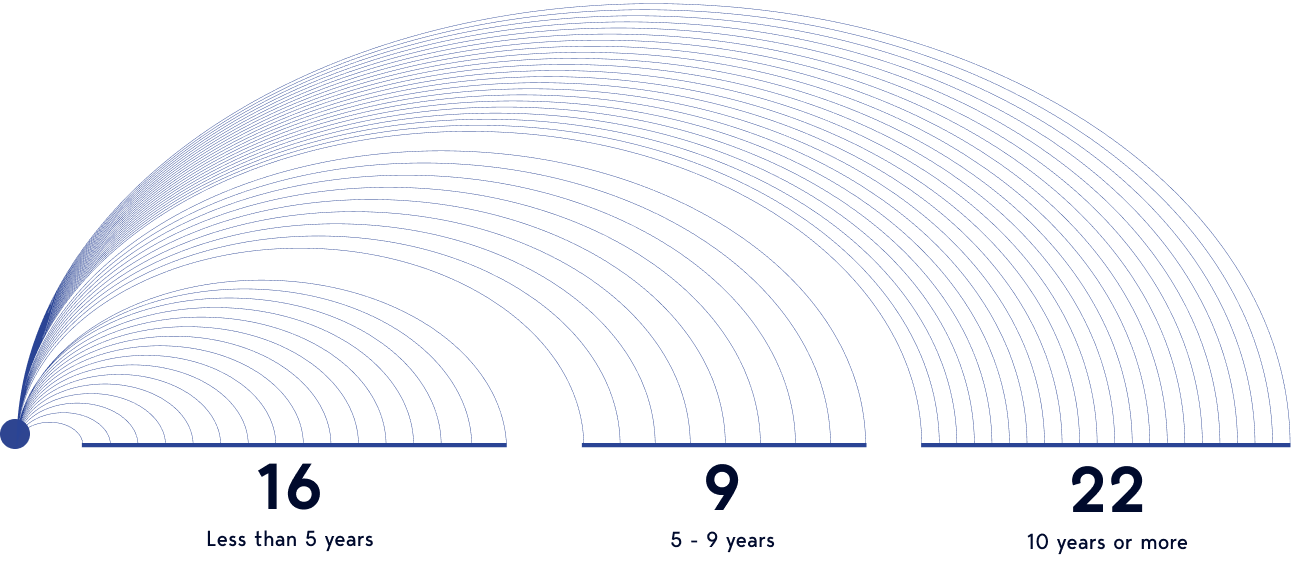

How long have we held these businesses?

When we say we invest for the long term, we mean decades. One of our founders expressed a strongly held view that continues to represent the essence of our investment philosophy today: Compound growth x time = investment nirvana. So, nearly half the stocks we hold in a typical global portfolio have been held for more than a decade.

The ideas and companies shaping the portfolio

As bottom-up stock pickers we seek out companies that can deliver long-term returns for our investors. However, Growth Vectors have been part of Walter Scott’s investment culture since the firm’s inception in 1983. We define them as areas of the economy underpinned by persistent growth trends over time, and they help us find those winning companies.

Digitisation

TSMC

ASML

Experian

Amadeus

Rising living standards

LVMH

Ferrari

L’Oreal

Nike

Adidias

Demographics

Stryker

Intuitive Surgical Edwards Lifesciences Roche

Novo Nordisk

Productivity

Keyence

Ferguson

O’Reilly Automotive Jardine Matheson Atlas Copco

This information should not be considered a recommendation to purchase or sell any security. There is no assurance that any securities shown in this presentation will remain in a portfolio at the time you receive this information or that any securities sold have not been repurchased. It should not be assumed that any holdings referred to have been or will prove to be profitable or that any investment decisions made in the future will be profitable.